Final Paycheck for Terminated Employee

If an employee is fired or discharged from employment, they must be paid their final paycheck on the same day as termination.

By Brad Nakase, Attorney

Email | Call (800) 484-4610

Final Paycheck for Terminated Employee

Employees who are discharged must be paid all wages due at the day and time of termination. Under California law, employees are afforded certain rights and protections when it comes to receiving their final paycheck. The state mandates that all employers, regardless of the size of their business, have a legal obligation to pay their employees their final wages upon termination of employment. Whether an individual was terminated by the employer or voluntarily resigned, the final paycheck must be provided promptly.

The final paycheck encompasses the entire amount of wages earned by the employee since the date of their last regular paycheck. This includes not only the base salary or hourly wages but also any accrued and unused vacation time, paid time off, or other benefits owed to the employee. Employers who received a demand letter or lawsuit from an employee concerning final pay should contact our employer defense attorney because there are time limits to respond.

Last Paycheck for Employee Who Resigned

It is important to note that California labor laws take these final paycheck provisions seriously, and any delays or failure by the employer to provide the final paycheck within the stipulated time frame can result in significant penalties for the employer.

If an employer fails to pay the final wages on time, they may be subject to “waiting time penalties.” These penalties amount to a full day’s wages for every day the employer delays the final payment, up to a maximum of 30 days. The waiting time penalties are in addition to the amount owed in the final paycheck, making it essential for employers to comply with the state’s regulations promptly.

As a California employee, you have the right to enforce these provisions and seek the final paycheck you are owed, including any accrued vacation pay or other benefits. If you encounter any delays or issues in receiving your last paycheck, it is advisable to communicate with your employer in writing to address the matter. In case the situation remains unresolved, you can file a wage claim with the California Division of Labor Standards Enforcement (DLSE).

Do employees get paid after termination in California?

In California, the rights of employees extend beyond just their regular work hours. When it comes to the final paycheck after termination, the state enforces stringent regulations to ensure that employees are promptly compensated for their work. Regardless of the nature of employment — whether part-time, short-term, temporary, or exempt — all terminated employees are entitled to receive their final paycheck immediately.

The final paycheck, in this context, comprises all wages that the employee has earned up until the date of termination. This includes not only the base salary or hourly wages but also any other payments or benefits that the employee has accrued but not yet received. For example, if an employee has accumulated vacation time, paid time off, or any other outstanding benefits, they must be included in the final paycheck.

California law leaves no room for ambiguity when it comes to paying terminated employees. As soon as the employment relationship is terminated, the employer is under a legal obligation to provide the final paycheck to the employee immediately. This “immediately” requirement means that the final wages must be handed over at the time of termination or as part of the employee’s exit process. There should be no delay or waiting period for the employee to receive their rightful compensation.

Furthermore, the obligation to provide the final paycheck exists irrespective of the type of employment. Whether the employee was part-time, short-term, temporary, or exempt from certain labor laws, they are still entitled to receive their final wages upon termination. This equal treatment ensures that all employees are treated fairly and in accordance with California’s labor laws.

It is important for both employers and employees to be aware of these rights and obligations to prevent any disputes or misunderstandings during the termination process. Failure to comply with these regulations can result in severe penalties for the employer, including waiting time penalties. As stated above, these penalties may amount to a full day’s wages for each day the employer delays the final payment, up to a maximum of 30 days.

In sum, the final paycheck after termination in California is a crucial aspect of employees’ rights. Regardless of the type of employment or exempt status, all terminated employees must be paid immediately upon termination. Employers must adhere to these regulations to avoid penalties and ensure that their employees are treated fairly and with the respect they deserve. Being informed about these rights empowers employees to assert themselves and seek redress if necessary, further strengthening California’s labor laws and protections for the workforce.

Do you get paid after quitting your job?

When an employee decides to quit their job in California, there are specific rules and requirements regarding their final pay. The timing of the final paycheck is dependent on the length of notice the employee provides to their employer.

If you choose to quit your job and give your employer at least 72 hours’ notice before your last day of work, your employer must provide your final paycheck on your last day. This means that when you officially finish your employment, your employer is obligated to hand over the final paycheck, which includes all wages earned up until that day, along with any accrued and unused vacation time or paid time off.

Providing sufficient notice benefits both parties — the employer has time to plan for your departure, and you receive your final paycheck promptly on your last working day. It allows for a smooth transition and ensures that you are compensated fairly for the work you have completed.

However, if you quit your job without providing the required notice of at least 72 hours, the rules for receiving your final paycheck change. In this scenario, your employer must still pay you, but they have up to 72 hours from the time of your resignation to supply your last paycheck.

For instance, if you resign without giving any prior notice, your employer has three days to deliver your final paycheck, starting from the moment you officially quit. During this 72-hour period, the employer should process your final wages, taking into account all the hours you worked up until your resignation date, as well as any outstanding vacation pay or benefits owed.

It is essential for employees to be aware of these regulations when considering quitting their job. Providing sufficient notice allows for a more amicable separation and ensures that you receive your final paycheck on time. On the other hand, if you find yourself in a situation where you need to resign without giving notice, understanding the employer’s obligation to pay within 72 hours provides you with clarity on when to expect your final wages.

Final paycheck law in California aims to protect the rights of both employers and employees, and these regulations pertaining to final paychecks after quitting a job ensure that employees are treated fairly and are compensated promptly for their work.

In conclusion, if you decide to leave your job in California, getting your final paycheck is dependent on the notice you provide to your company. Giving at least seventy-two hours’ notice entitles you to receive your last paycheck on your final day of work. If you resign without providing the required notice, your company must still pay you within the following 72 hours. Understanding these requirements empowers employees to make informed decisions about their employment and ensures that they receive their rightful compensation when transitioning to new opportunities.

What does termination pay mean?

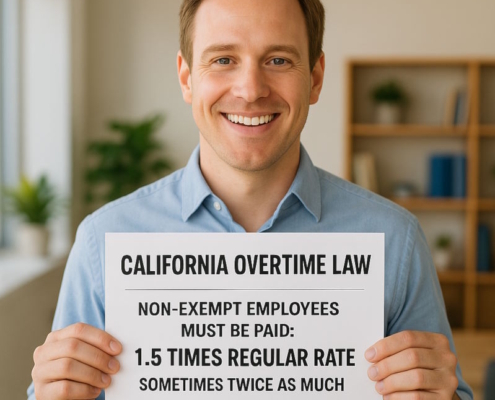

In California, the termination of employment triggers important legal requirements regarding termination pay. Employers are obligated to include all hours worked by the employee in their final paycheck, leaving no room for discrepancies or omissions. This means that termination pay should encompass not only regular hours but also any double time and overtime hours worked by the employee.

Additionally, any accrued and paid time off (PTO) that has not been used must be included in the final paycheck. Employees are entitled to be compensated for the PTO they earned but did not use at the time of their termination. However, it is important to be aware that available sick pay will not necessarily be provided in the last paycheck. To determine entitlement to sick pay proceeds, employees should carefully review their employment agreement or company policy.

One critical aspect of California termination pay is that employers are not allowed to conditionally withhold the final paycheck, whatever their rationale. Even if the employer requires an NDA or any other condition, they cannot use this as a basis for withholding the employee’s last paycheck. The final paycheck must be provided promptly upon termination, and employers cannot delay or impose conditions on its release.

Even in cases where an employment agreement stipulates that vacation time is not accessible until after a certain period of employment, built-up vacation must still be paid out upon termination. Figuring out the proportion of time the employee worked prior to the end of employment will determine the amount of unpaid vacation owed to the employee.

Additionally, if an employee requests to have their final paycheck mailed to them, the employer is legally obliged to comply with the request. Employers cannot require the employee to take the paycheck themselves, giving employees the flexibility to receive their final wages in a manner that suits their circumstances.

California’s labor laws regarding termination pay are in place to ensure fair compensation for employees after their employment ends. These regulations protect employees from potential exploitation and provide a clear framework for employers to follow when it comes to issuing final paychecks.

California employees should be aware of their rights and entitlements regarding termination pay. The final paycheck must include all hours worked, including overtime and double time, along with any unused PTO. While unused sick pay is not guaranteed, accrued vacation must be paid out. Employers cannot conditionally hold the final paycheck or require unreasonable conditions for its release. Understanding these regulations empowers employees to advocate for their rights and receive the compensation they deserve when their employment comes to an end.

What are the penalties for late paychecks?

In California, timely payment of wages is a fundamental right for employees. To ensure employers comply with this requirement, the state imposes penalties for late paychecks, guaranteeing that employees receive their due compensation promptly. If an employer withholds an employee’s final paycheck or causes delays in payment, they may be subject to a penalty known as the “waiting time penalty.”

This penalty is a daily penalty that is imposed on the employer for each day they fail to provide the employee’s final paycheck after termination or resignation. The amount of the penalty is based on the employee’s daily wages, which is typically calculated by adding the employee’s base wages, bonuses, commissions, as well as vacation pay earned per year. This sum is then divided by fifty-two weeks and divided by five days to arrive at the daily rate of pay.

The waiting time penalty continues to accrue for a maximum of thirty days. After 30 days, the penalty stops, and the employer is no longer subject to additional waiting time penalties. However, it is crucial to note that this does not absolve the employer of their responsibility to pay the outstanding wages owed to the employee.

If an employer fails to provide the final paycheck and the waiting time penalty does not prompt timely payment, the employee may need to take further action. If 30 days pass, and the employee still has not received their final wages, they may consider initiating legal action against the company to recover the unpaid wages. This could involve filing a lawsuit to pursue the owed wages, waiting time penalties, and any additional damages allowed under California labor laws.

It is important for employees to be aware of their rights and the potential penalties their employer may face for late paychecks. Understanding these regulations empowers employees to take appropriate action if they experience delays in receiving their final paycheck after termination or resignation.

California labor laws prioritize the timely payment of wages to protect employee rights. Employers who withhold final paychecks or cause payment delays may be subject to waiting time penalties. These penalties, based on the employee’s daily rate of pay, continue to accrue for a maximum of 30 days. After this period, the employer is still obligated to provide the unpaid wages, but the penalty ceases. If timely payment is not made within this timeframe, employees may consider pursuing legal action to recover their unpaid wages and penalties through a lawsuit. Being informed of these penalties empowers employees to safeguard their rights and seek appropriate recourse if necessary, reinforcing California’s commitment to fair labor practices.

Have a quick question? We answered nearly 2000 FAQs.

See all blogs: Business | Corporate | Employment

Most recent blogs: